Weekly Stock Market Recap: June 27 - July 4, 2025

Welcome to this week’s stock market update from Link Financial Advisory, your trusted partner for personal financial planning and wealth management in Missoula. Let’s dive into a detailed analysis of what happened in the markets over the past week, from June 27 to July 4, and explore what it means for investors. This recap covers both domestic and international markets, including equities and fixed income, offering insights to help you navigate your financial journey with confidence.

Market Overview

The week of June 27 to July 4, 2025, was marked by solid gains in US stock markets, despite a shortened trading week due to the Independence Day holiday on July 4. The major US indices performed as follows:

| Index | Weekly Performance | Closing Value (July 3, 2025) |

|---|---|---|

| S&P 500 | +1.7% | 6,279.35 |

| Dow Jones Industrial | +2.3% | 44,828.53 |

| Nasdaq Composite | +1.6% | 20,601.10 |

| MSCI EAFE (International) | +0.1% | N/A |

The S&P 500 and Nasdaq hit record-high closes, while the Dow reached its highest level since February 2025, according to Edward Jones. Internationally, developed markets outside the US, tracked by the MSCI EAFE index, saw a modest gain of +0.1%, reflecting a more cautious global sentiment compared to the robust US performance.

In the fixed income space, domestic bonds faced slight headwinds. The iShares Core U.S. Aggregate Bond ETF (AGG), which tracks a broad range of US bonds, declined by -0.3%, potentially due to a +0.1% increase in the 10-year Treasury yield to 4.35%. Oil prices rose by +2.3%, which could have mixed implications—benefiting energy stocks but potentially adding inflationary pressure to other sectors.

What Helped The Stock Market

Several positive developments drove the market’s upward momentum last week:

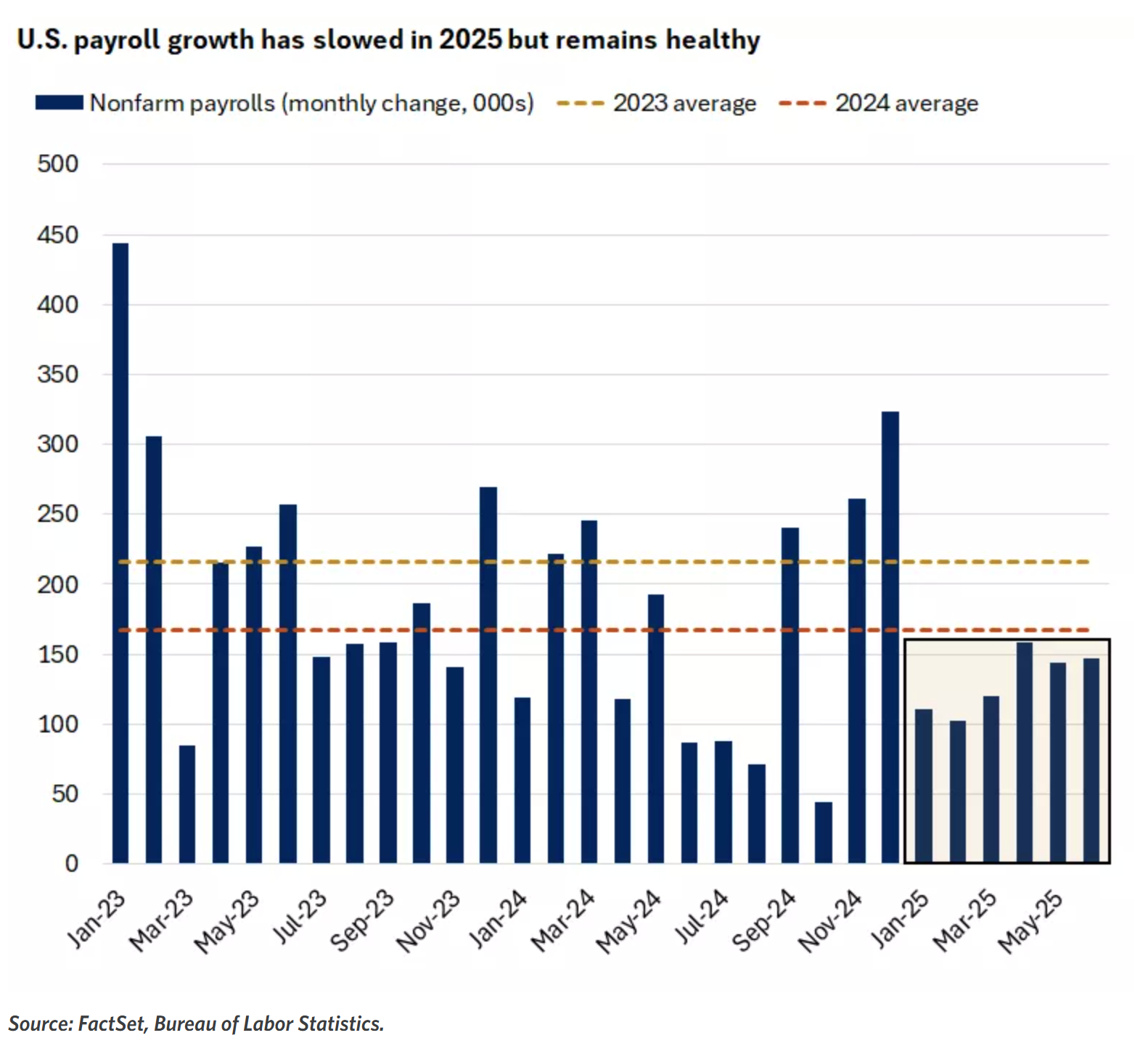

Robust US Jobs Report

On July 3, 2025, the US Labor Department released a stronger-than-expected jobs report for June. Nonfarm payrolls increased by 147,000, surpassing economists’ estimates of 118,000. The unemployment rate fell to 4.1%, better than the anticipated 4.3%, and average hourly earnings grew by 0.2% month-over-month, aligning with expectations. This resilient labor market data signals a healthy economy, boosting investor confidence and supporting gains across major indices.

US-Vietnam Trade Deal

On July 2, 2025, President Trump announced a trade agreement with Vietnam, reducing tariffs on Vietnamese goods imported to the US from 46% to 20%, with a 40% tariff on transshipped goods to curb circumvention of trade barriers. This deal alleviated concerns about escalating trade tensions and provided clarity for businesses and investors, particularly in sectors reliant on international trade. The agreement was a significant step ahead of the July 9 deadline for the 90-day tariff pause, reducing uncertainty and contributing to the bullish market sentiment.

These factors helped propel the S&P 500 and Nasdaq to fresh all-time highs, with the Dow outperforming due to its exposure to industrial and financial stocks, which benefited from the positive economic data.

What Hurt The Stock Market

Despite the overall positive sentiment, some factors presented challenges:

Fixed Income Underperformance

The domestic fixed income market experienced a slight decline, with the iShares Core U.S. Aggregate Bond ETF (AGG) falling by -0.3%. This underperformance may be attributed to a +0.1% increase in the 10-year Treasury yield to 4.35%, which can inversely affect bond prices. While bonds remain a critical component for portfolio stability, their short-term performance can be sensitive to interest rate movements and economic data.

Ongoing Trade Uncertainty

While the US-Vietnam trade deal was a positive development, uncertainty persists around trade negotiations with other countries, including China, the EU, and Japan, as the July 9 tariff deadline approaches. Reuters highlighted that the Trump administration has made progress but released limited details, which could introduce volatility if deadlines are not extended or agreements falter. This uncertainty may have contributed to the modest performance of international markets, as reflected in the MSCI EAFE’s +0.1% gain.

Oil Price Increase

Oil prices rose by +2.3% last week. While this can benefit energy stocks, it may also fuel inflationary concerns or increase input costs for other sectors, creating a mixed impact on the market. For example, higher oil prices could pressure consumer discretionary and transportation sectors, potentially offsetting some of the gains driven by positive economic data.

Sector Performance and Key Movers

To provide a deeper look into the US market, let’s examine sector performance and individual stock movements, as reported by Morningstar:

| Sector | Weekly Performance |

|---|---|

| Basic Materials | +3.59% |

| Financial Services | +2.64% |

| Utilities | +0.58% |

| Communication Services | +0.63% |

The Morningstar US Market Index rose by +1.8%, slightly outperforming the S&P 500’s +1.7%. The Basic Materials sector led with a gain of +3.59%, likely driven by rising commodity prices, including oil. Financial Services followed with a +2.64% increase, benefiting from the strong economic data and expectations of stable or rising interest rates. Conversely, Utilities and Communication Services lagged, with gains of only +0.58% and +0.63%, respectively, possibly due to their defensive nature in a risk-on market environment.

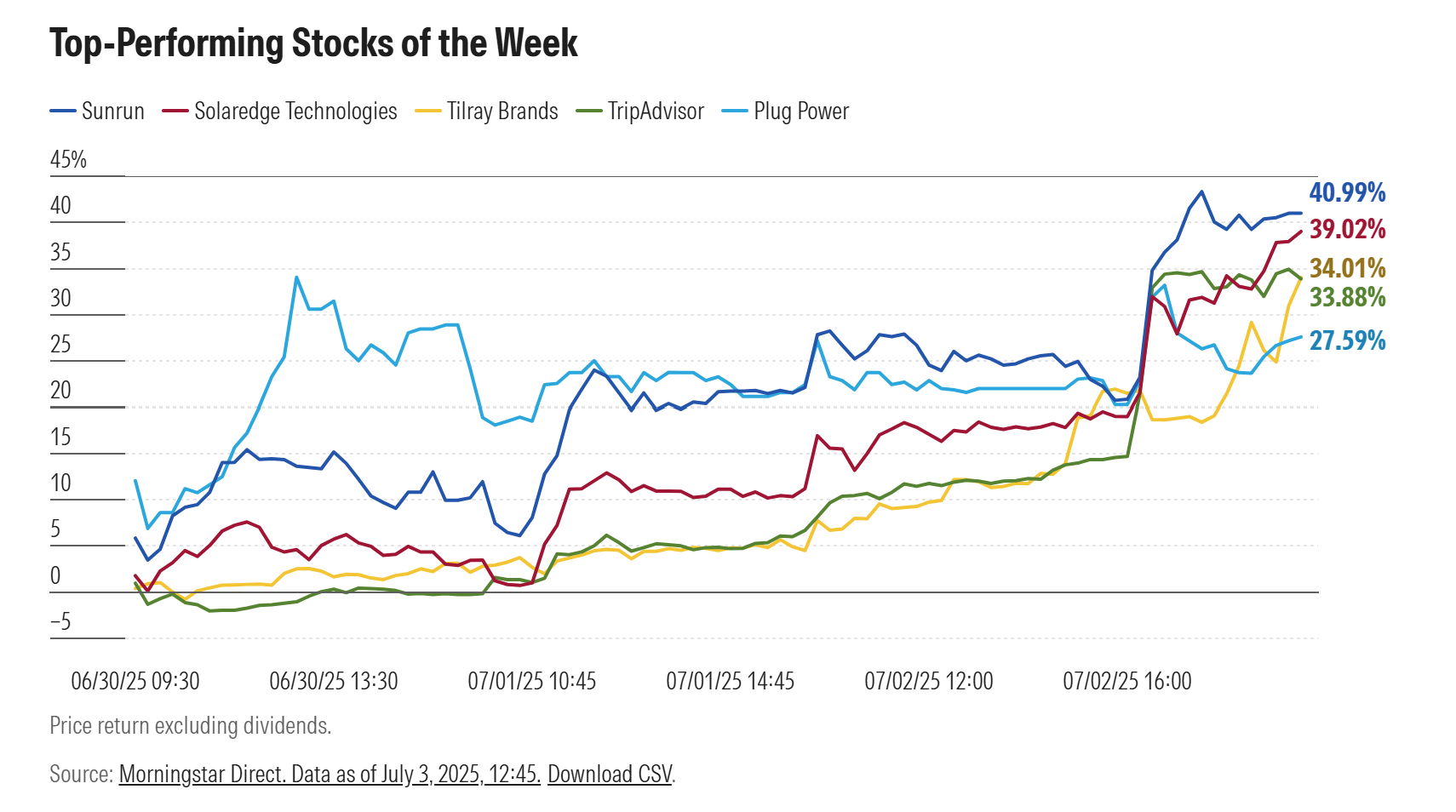

Notable stock movers included:

- Top Gainers:

- Sunrun (RUN): +40.99%, driven by renewed interest in renewable energy stocks.

- Solaredge Technologies (SEDG): +39.02%, reflecting similar sector enthusiasm.

- Tilray Brands (TLRY): +34.01%.

- TripAdvisor (TRIP): +33.88%.

- Plug Power (PLUG): +27.59%.

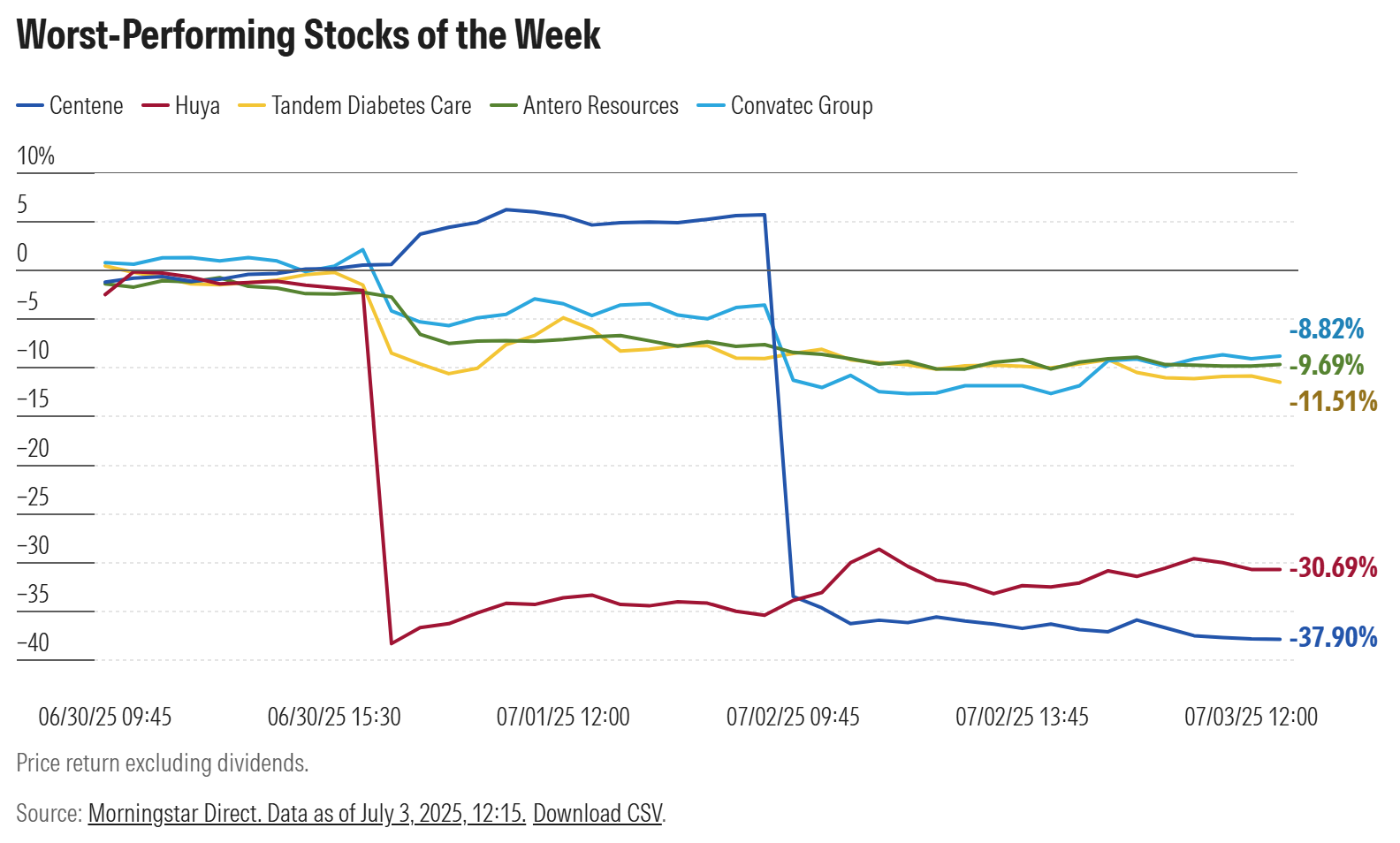

- Top Losers:

- Centene (CNC): -37.90%, possibly due to company-specific challenges or sector headwinds.

- Huya (HUYA): -30.69%, reflecting volatility in tech-related stocks.

These movements highlight the significant volatility within specific sectors and companies, even in a broadly positive market week.

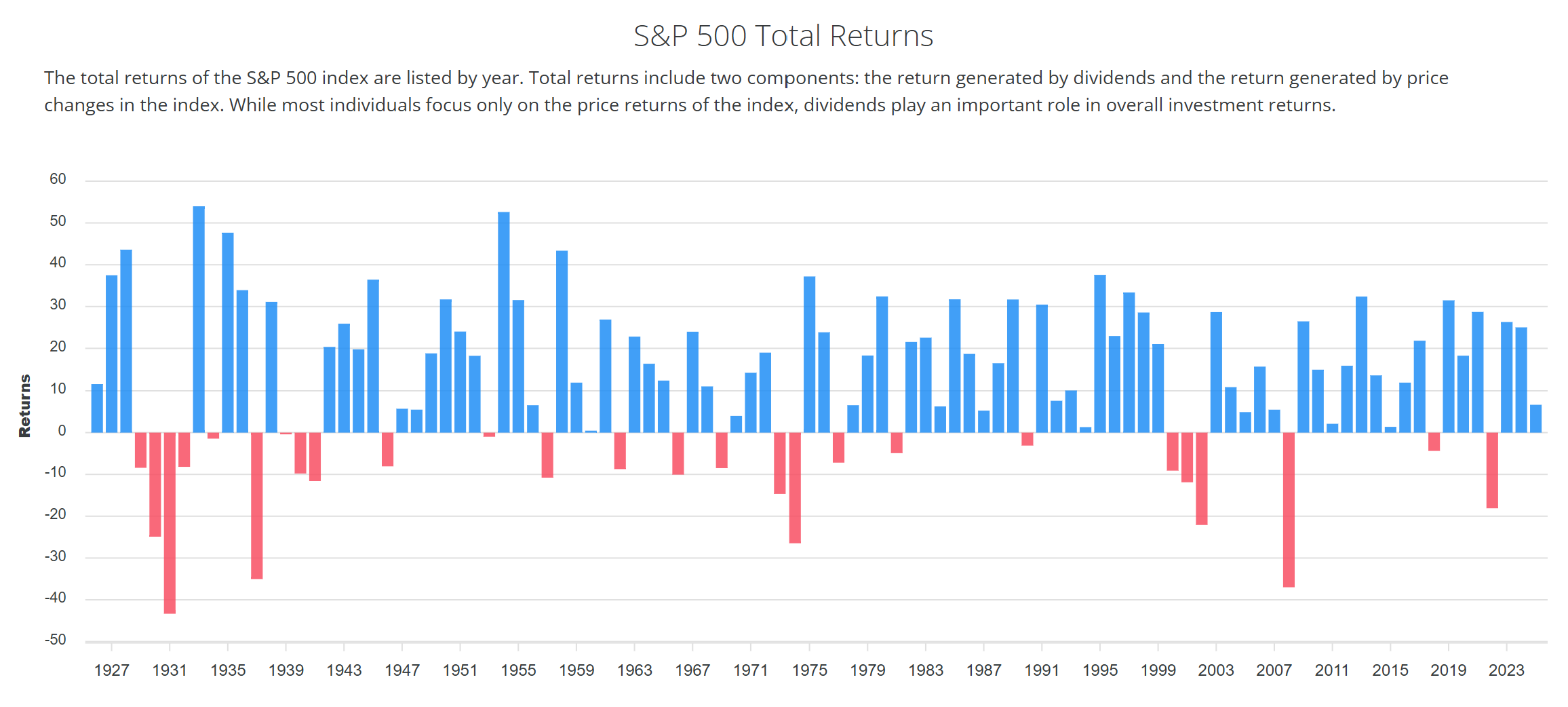

Long-Term Perspective: Historical Returns of the S&P 500

To provide context for investors, it’s crucial to consider the long-term performance of the stock market. The S&P 500 has delivered impressive average annual returns over various time horizons:

| Time Period | Average Annual Return | Total Return (Approximate) |

|---|---|---|

| 1 Year (2024) | 25.02% | 25.02% |

| 5 Years (2020–2024) | 16.43% | 113.8% |

| 10 Years (2015–2024) | 12.566% | 226.7% |

| 20 Years (2005–2024) | 10.364% | 617.7% |

A $10,000 investment in the S&P 500 twenty years ago would have grown to approximately $72,000 today, reflecting a total return of about 617.7%. This underscores the power of long-term investing, as the market has historically weathered short-term fluctuations to deliver positive returns over extended periods.

Global Market Influences

While US markets performed strongly, international markets showed more caution. The MSCI EAFE index’s modest +0.1% gain reflects ongoing trade uncertainties and economic challenges in other regions. Key international influences include:

- US-Vietnam Trade Deal: As a manufacturing hub, Vietnam’s role in global supply chains makes this deal significant for investors with exposure to international trade. The agreement has ripple effects in Asia, where Vietnam competes with other manufacturing economies.

- Broader Trade Negotiations: Uncertainty around trade talks with major partners like China, the EU, and Japan could impact global markets. American investors should monitor these developments, as they could affect US companies with international operations.

- Chinese Economic Outlook: J.P. Morgan Research forecasted a slowdown in Chinese GDP growth to 4.8% for 2025, citing trade uncertainty and housing market weakness. This could dampen global demand and affect US companies with significant exposure to China.

These global dynamics highlight the interconnected nature of today’s markets and the importance of diversification for American investors.

Key Takeaways for Investors

For investors, last week’s market performance offers several actionable insights:

- Stay Informed on Economic Indicators: The strong June jobs report underscores the importance of monitoring economic data, as it can significantly influence market movements. A robust labor market supports consumer spending, which drives much of the US economy.

- Monitor Trade Developments: The US-Vietnam deal is a positive step, but the July 9 tariff deadline could introduce volatility. Diversifying across sectors and geographies can mitigate risks associated with trade policy shifts.

- Diversification is Essential: While equities performed well, fixed income saw a slight decline, emphasizing the importance of a balanced portfolio that includes both stocks and bonds.

- Maintain a Long-Term Perspective: The S&P 500’s historical returns highlight the value of staying invested over the long term. A $10,000 investment twenty years ago would have grown to approximately $72,000 today, despite periods of market turbulence.

Call to Action

If you’re looking to optimize your investment strategy, a plan administrator looking to benchmark your 401k, or you need assistance with personal financial planning, Link Financial Advisory is here to help. As a local Missoula financial advisory team, we specialize in wealth management and providing tailored solutions for high-net-worth individuals, those inheriting wealth, or C-suite executives managing their company’s 401k plans.

Contact us today to schedule a consultation and take control of your financial future. Let us help you navigate these dynamic markets with confidence.

Conclusion

The week of June 27 to July 4, 2025, showcased the resilience of US stock markets, driven by a strong jobs report and a positive trade deal with Vietnam. While fixed income faced slight challenges and global markets remained cautious, the overall outlook is optimistic. For investors, staying diversified, informed, and focused on long-term goals is key to navigating market fluctuations.

At Link Financial Advisory, we’re committed to helping you make sense of these trends and build a financial plan that aligns with your aspirations. Whether you’re seeking personal financial planning, wealth management, or 401k benchmarking, our team is here to guide you every step of the way.

Citations:

Member discussion