Weekly Stock Market Recap: July 18-25, 2025 – Navigating Opportunities in a Resilient Economy

At Link Financial Advisory, we’re committed to providing clear, actionable insights into the markets to support your personal financial planning and wealth management goals. Whether you’re benchmarking your 401k plan or seeking strategies for long-term growth, understanding weekly trends helps build a solid foundation. This past week, US equities demonstrated resilience amid positive earnings and evolving trade discussions, while fixed income markets offered stability. Globally, progress in international relations provided a boost, though some regions faced headwinds.

Domestic Equities: Steady Gains Amid Earnings Momentum

The US stock market closed the week on a positive note, with major indices reflecting broad optimism driven by robust corporate earnings and encouraging economic indicators. The S&P 500 advanced approximately 1.5%, reaching a new record close at 6,388.64, marking its fifth consecutive weekly high in 2025. This performance built on a year-to-date gain of about 7.1%, underscoring the index's ability to recover from earlier volatility, such as the April dip triggered by tariff announcements. The Nasdaq Composite followed suit, rising 1.2% to 21,108.32—its 15th record close this year—fueled by strength in technology and growth-oriented sectors. Meanwhile, the Dow Jones Industrial Average remained relatively flat, edging up just 0.3% to 44,484.49, as investors showed caution in more traditional industrial stocks.

Past week | Year-to-date | 5-year | |

| S&P 500 | 1.2% | 8.9% | 95.4% |

| Oil (WTI crude) | –3.5% | –10.9% | 61.7% |

| Gold (New York) | –0.5% | 25.6% | 70.1% |

| Bitcoin | –0.4% | 23.6% | 1,078.6% |

Key drivers included a wave of Q2 earnings reports, where 88% of S&P 500 companies beat analyst expectations through July 25. Economic data also played a supportive role: Durable goods orders declined less than forecasted (-9.3% vs. -11% expected), and retail sales rose 0.6% in June, signaling sustained consumer spending. Jobless claims dropped to 217,000, highlighting labor market strength. However, elevated valuations—with the S&P 500’s forward P/E ratio at 22.3—introduced some investor hesitation, as earnings growth needs to continue justifying these levels.

Top Performers of the Week

Standout stocks led the charge, particularly in consumer discretionary and industrials. Deckers Outdoor (DECK) surged about 14%, driven by exceptional sales from its Hoka and Ugg brands, exceeding revenue forecasts and boosting confidence in consumer demand.institutional.vanguard.com PepsiCo (PEP) gained around 7%, thanks to strong quarterly results that highlighted resilient pricing power and volume growth in snacks and beverages. United Airlines (UAL) climbed 3%, benefiting from robust travel demand and efficient operations amid a busy summer season. Tesla (TSLA) also rebounded notably, up approximately 5%, as investors reacted positively to production updates and easing concerns over prior sell-offs. These performers exemplify how companies with solid fundamentals can thrive, a key consideration in wealth management strategies at firms like ours.

Biggest Losers of the Week

On the flip side, some stocks faced setbacks from disappointing earnings or sector-specific pressures. Intel (INTC) dropped sharply after weak guidance, losing about 8%, as challenges in the semiconductor space weighed on investor sentiment. Centene (CNC) fell 15%, following a downward revision to its 2025 outlook amid rising healthcare costs and regulatory scrutiny. These declines highlight the risks in overvalued tech subsectors and underscore the importance of diversification in personal financial planning.

Domestic Fixed Income: Stability in a Volatile World

The bond market provided a counterbalance to equities, with Treasury yields easing slightly as investors sought safer assets during trade negotiations. The 10-year Treasury yield dipped to 4.385% from 4.423% at the week's start, reflecting modest gains in bond prices and a flight to quality. This movement aligns with expectations of one to two Federal Reserve rate cuts later in 2025, with the fed funds rate holding at 4.25-4.50%. Investment-grade corporate bonds outperformed Treasuries, with spreads tightening, while high-yield bonds edged up 0.04%, indicating sustained risk appetite. Municipals, however, declined 0.98% due to local fiscal pressures.

BlackRock's fixed income outlook emphasizes the potential for higher-for-longer rates, which could benefit income-focused portfolios.

International Markets: Trade Progress and Regional Variations

Globally, markets reacted positively to advancements in trade talks, though uncertainties lingered. European equities advanced, with Germany's DAX up 0.6% and France's CAC 40 rising 0.8%, buoyed by a nearing US-EU deal capping tariffs at 15-20%. This progress, along with a US-Japan agreement at 15% reciprocal tariffs and Japan's $550 billion investment pledge in the US, supported multinational firms.invesco.com Invesco's global outlook notes improved growth prospects outside the US, potentially offsetting domestic slowdowns.

Asian markets were more mixed, subdued by ongoing US-China tensions and a looming 145% tariff on Chinese goods ahead of the August 1 deadline. Japan's 10-year bond yield rose to 1.59% amid post-election political shifts, adding to volatility. Emerging markets showed resilience but remain sensitive to geopolitical risks, with OECD projecting global growth at 1.6% for 2025. American investors should monitor these developments, as 28% of S&P 500 revenues come from overseas.

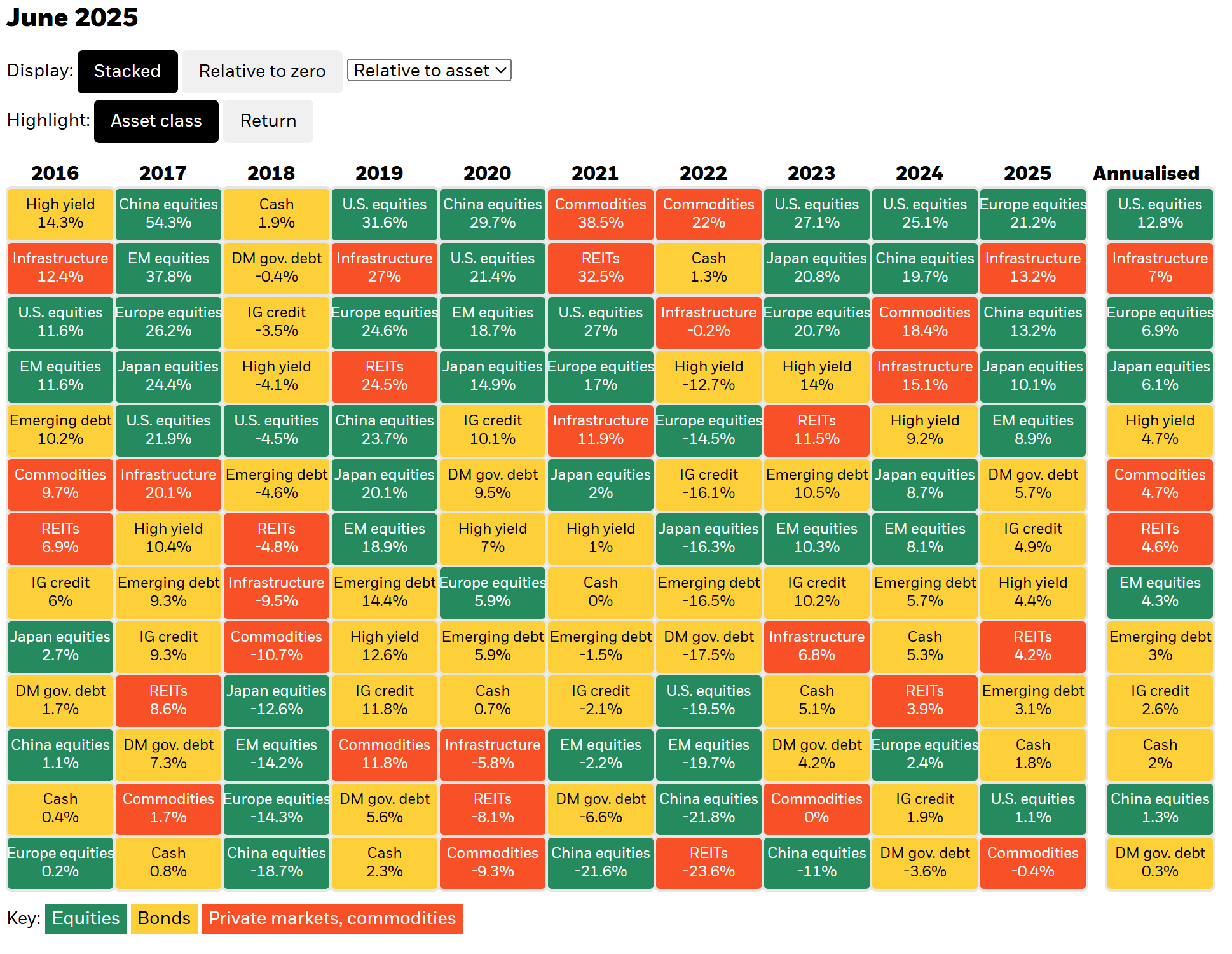

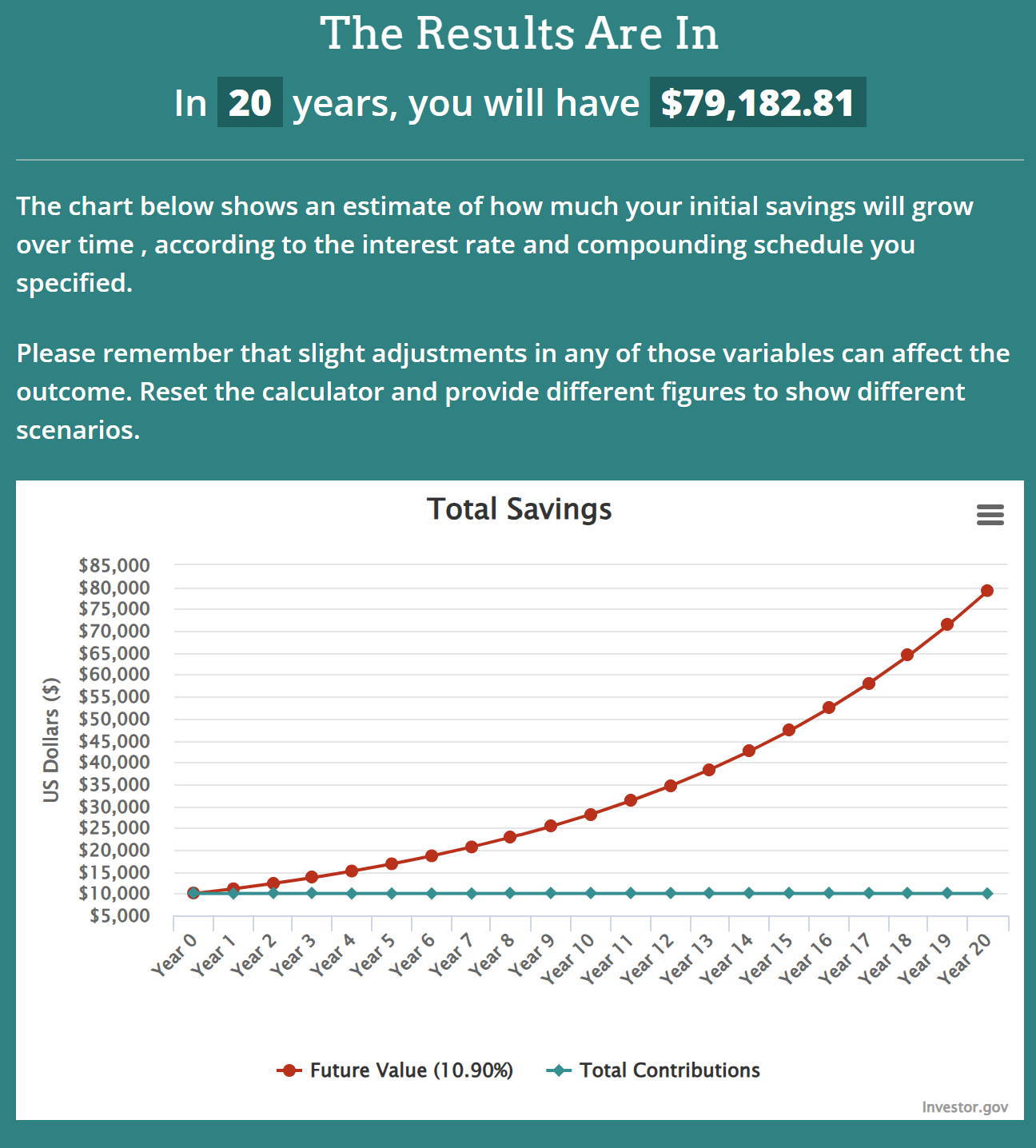

Long-Term Perspective: The Power of Patience

While weekly fluctuations grab headlines, a long-term view reinforces the benefits of staying invested. The S&P 500 has delivered strong returns: up 17.17% over the past year, with annualized rates of 15.5% over 5 years (total return 105.8%), 12.6% over 10 years (224.4%), and 10.9% over 20 years (696.1%). A $10,000 investment in July 2005 would now be worth about $79,182, dividends reinvested, weathering events like the 2008 crisis, 2020 pandemic, and 2025 tariff volatility.

Key Takeaways and Looking Ahead

This week's market activity highlights resilience, with earnings and trade progress outweighing valuation concerns and policy risks. For investors, diversification across equities, fixed income, and international assets remains essential. At Link Financial Advisory, our local Missoula team tailors personal financial planning to these dynamics, whether optimizing your 401k or building a comprehensive wealth management strategy.

If these insights resonate, consider reaching out to discuss how we can apply them to your situation. Stay informed, and remember: Markets reward the patient and prepared.

Member discussion