Weekly Stock Market Recap: July 11-18, 2025 – Insights from Link Financial Advisory

In this week's recap, we'll dive into the market movements from July 11 to July 18, 2025, covering domestic and international equities, fixed income trends, and key drivers. Our goal is to provide actionable context that supports long-term strategies, whether you're optimizing your retirement savings or seeking a second opinion on your investments. Let's break it down.

Domestic Equities: Modest Gains Amid Sector Rotation

The U.S. stock market wrapped up the week with modest overall advances, reflecting resilience in the face of mixed signals. The S&P 500 climbed 0.6% to close at 6,296.79, marking another record high during the period. The Nasdaq Composite led the pack with a 1.5% gain, ending at 20,895.70, buoyed by technology and growth-oriented sectors.apnews.comjhinvestments.com In contrast, the Dow Jones Industrial Average dipped slightly by 0.1%, finishing at 44,342.19, as value stocks faced some pressure.apnews.comcnbc.com

This performance highlights a subtle rotation away from mega-cap tech toward more cyclical areas, a trend we've been monitoring closely in our wealth management consultations. For instance, utilities surged 1.64% as investors sought defensive plays amid uncertainty, while industrials rose 1.2% on positive economic data.morningstar.com Financials also shone, with big banks like JPMorgan Chase and Goldman Sachs delivering earnings beats driven by robust trading revenues and capital markets activity—86% of early S&P 500 reporters exceeded expectations, above the 10-year average of 75%.edwardjones.com

On the flip side, some notable laggards dragged specific sectors. Waters Corporation (WAT) plummeted 15.95%, reflecting broader weakness in healthcare equipment amid earnings misses.morningstar.com Group 1 Automotive (GPI) fell 14.90%, hit by auto sector headwinds, while Elevance Health (ELV) dropped 8.4% following disappointing guidance.investopedia.commorningstar.com Netflix (NFLX) and American Express (AXP) also declined, by 5% and 2.3% respectively, underscoring volatility in consumer discretionary and financial services.

Domestic Fixed Income: Yields Steady with a Slight Uptick

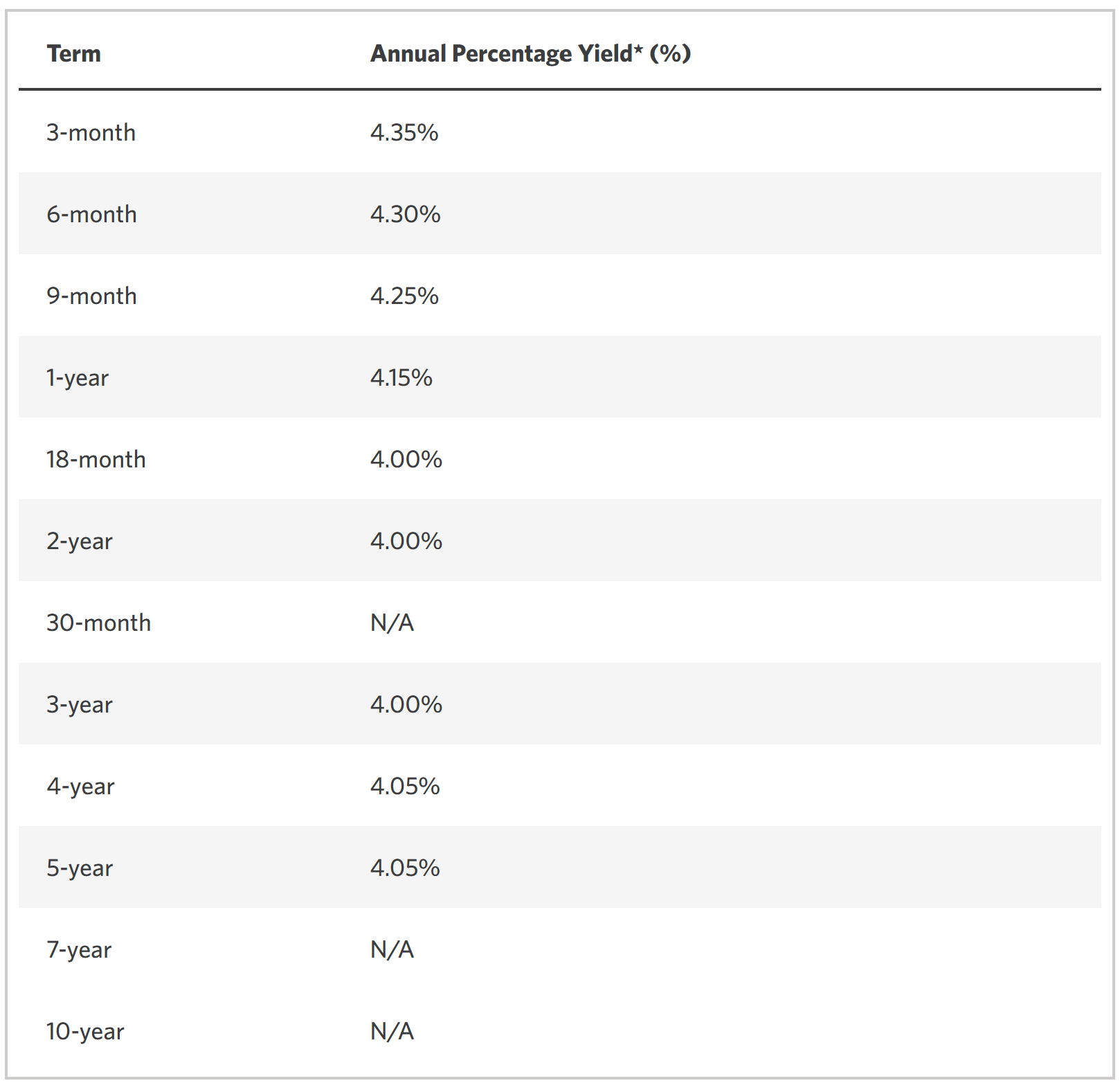

Fixed income markets remained stable but saw mild upward pressure on yields, offering opportunities for income-focused strategies in personal financial planning. The 10-year U.S. Treasury yield ended the week around 4.44%, up about 6 basis points, while the 2-year yield hovered at 3.88% and the 30-year at 5.00%.edwardjones.comblackrock.com This slight steepening of the yield curve—where longer-term rates rose more than short-term—reflects investor expectations of sustained economic growth without immediate rate cuts from the Federal Reserve.

Edward Jones notes that yields are likely to stay in the 4%–4.5% range for the 10-year, providing a reliable buffer for diversified portfolios. BlackRock emphasizes the appeal of short- and medium-term government bonds, with about 80% of global bonds yielding over 4%, making them attractive for 401k benchmarking and retirement income planning.

International Markets: Mixed Results with Trade Ripples

Globally, markets presented a patchwork of performances, which American investors should note when diversifying beyond domestic equities. The MSCI EAFE Index, tracking developed markets in Europe, Australasia, and the Far East, slipped 0.3% for the week. European indices like the Stoxx 600 edged up modestly by 0.2% in spots, supported by corporate earnings, but overall sentiment was tempered by tariff concerns. In Asia, results were mixed; Japanese and Chinese benchmarks held steady amid U.S.-China trade talks, but export-heavy sectors felt the pinch.

Fixed income internationally offered brighter spots, with euro area bonds (e.g., Spanish debt) yielding over 5% when hedged to USD, per BlackRock. Emerging markets debt remained appealing for yield seekers, though volatility from U.S. policy shifts warrants caution in wealth management allocations.

Key Influences: Earnings Boost vs. Tariff Clouds

Several factors propelled the markets forward. Strong Q2 earnings, especially from tech giants and financials, signaled corporate health—big tech's AI investments and banks' trading surges were standout positives. Robust economic data, like June housing starts and retail sales, reinforced recovery narratives.blackrock.com Lower inflation readings and easing oil prices (WTI in the $60–$70 range) further supported consumer and business spending.

However, trade tensions loomed large, with reports of new U.S. tariffs on Canada and others causing brief dips, particularly in industrials and exports. Policy uncertainty around Fed leadership added fleeting volatility, though markets rebounded quickly.

Top Performers and Biggest Losers

Top performers included utilities leader NextEra Energy (NEE), up amid sector strength, and industrials like Caterpillar (CAT), benefiting from economic data.morningstar.com In tech, NVIDIA gained on relaxed China export rules.edwardjones.com

Biggest losers: Waters (WAT) and Group 1 Automotive (GPI) as noted, plus healthcare's Elevance Health (ELV) and consumer names like Netflix (NFLX).

Long-Term Perspective: The Power of Staying Invested

Zooming out, the S&P 500 has risen 13.6% over the past year, with annualized returns of 15.5% over 5 years, 12.5% over 10 years, and 10.9% over 20 years.macrotrends.net A $10,000 investment in the S&P 500 two decades ago would now be worth approximately $79,610, delivering a 696% total return with dividends reinvested. This underscores why, in our Missoula-based personal financial planning sessions, we emphasize patience and diversification over reacting to weekly fluctuations.

Wrapping Up: Opportunities Ahead

This week's market action reminds us that while short-term noise like tariffs can create ripples, fundamentals like earnings and economic data drive sustained growth. At Link Financial Advisory, our local Missoula team is here to translate these insights into tailored strategies—whether it's 401k benchmarking for your company's plan or comprehensive wealth management for your family's future. If you're inheriting assets or seeking a fresh perspective, reach out; we're committed to making complex markets accessible and your goals achievable.

Member discussion